Wonderful Info About Why Is It Called Dead Cat Bounce

What in the World is a Dead Cat Bounce? And Why That Name?

1. A Grim but Fitting Analogy

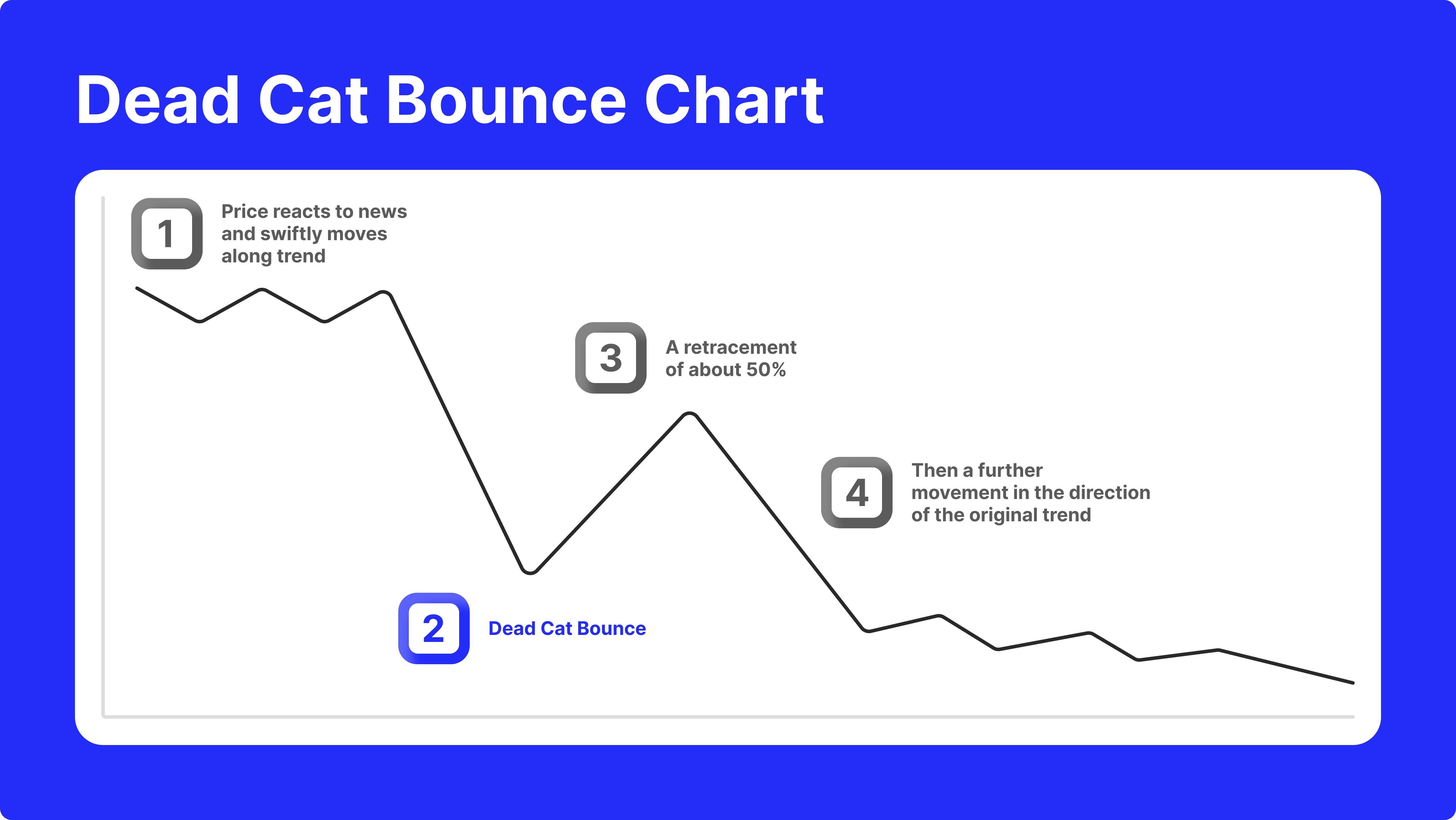

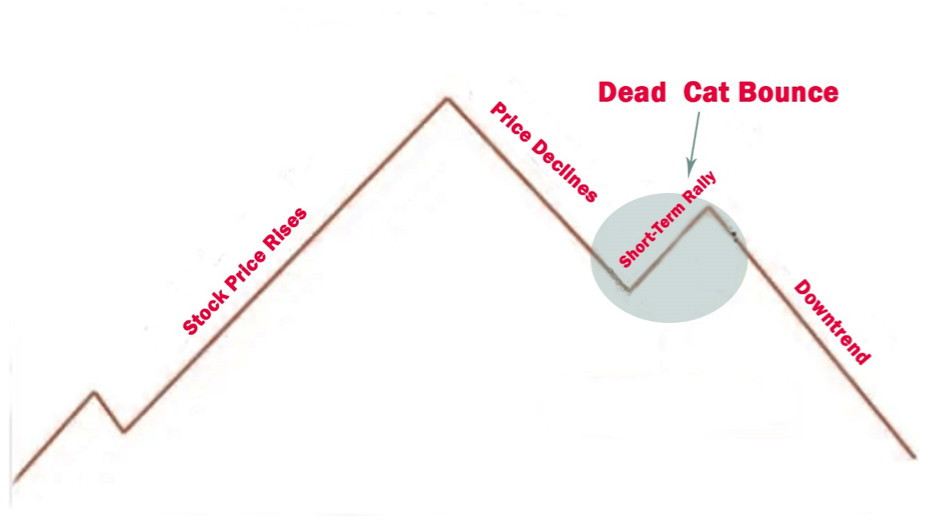

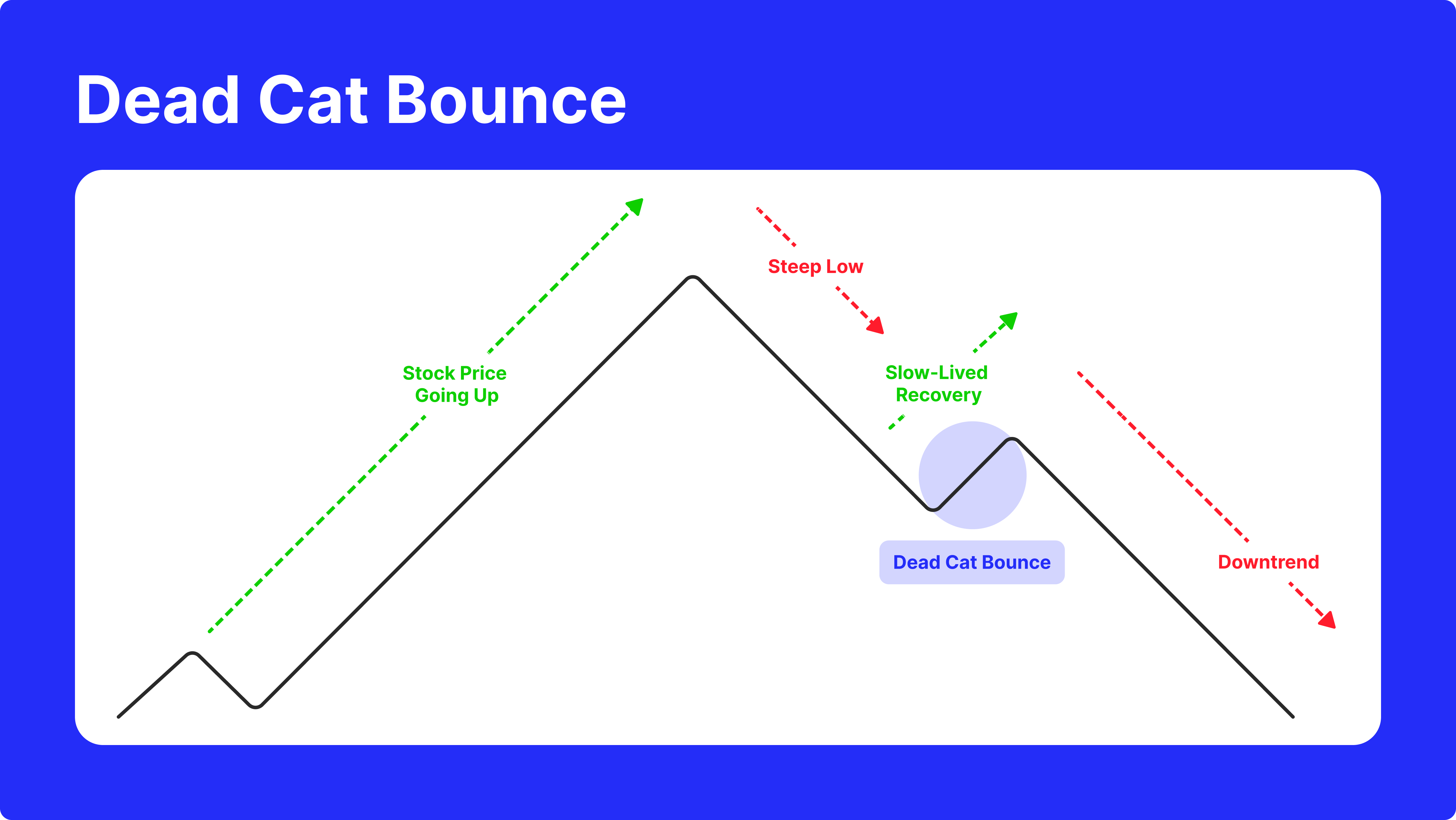

Ever heard the term "dead cat bounce" and wondered what morbid imagery it conjures up? It's a financial term, not something out of a horror movie, thankfully! The "dead cat bounce" describes a brief, often misleading, recovery in the price of a stock or other asset after a significant decline. The name, well, let's just say it's not exactly cheerful. The idea is that even a dead cat will bounce if dropped from a great height. Gruesome, I know, but it gets the point across, doesn't it? It's a temporary blip that shouldn't be mistaken for a real, sustained recovery.

Think of it like this: a company announces terrible earnings, its stock price plummets, investors panic. Then, for a day or two, maybe even a week, the price creeps back up a little. Some bargain hunters might jump in thinking it's a great buying opportunity. Others might be short-sellers covering their positions. But ultimately, the underlying problems that caused the initial drop are still there. That little upward tick? That's likely your dead cat bounce. A fleeting moment of hope before the real pain resumes.

The term itself, as far as historical records suggest, originated from the financial markets of the 1980s. While pinpointing the exact person who coined the phrase is difficult, it gained popularity among market analysts and traders who were looking for a catchy and somewhat cynical way to describe these fleeting rallies in downtrending markets. The inherent dark humor probably helped it stick around, too. It's a memorable phrase, even if it is a little unsettling.

So, the next time you see a stock price briefly rally after a big fall, remember the dead cat. It's a good reminder that not every uptick is a sign of a true turnaround. A healthy dose of skepticism is always a good thing when navigating the volatile world of finance.

What Is The Meaning Of Dead Cat Bounce In Investing?

Breaking Down the "Dead Cat Bounce"

2. More Than Just a Macabre Name

The "dead cat bounce" (noun phrase, acting as a noun) is more than just a colorful expression; it represents a genuine phenomenon in financial markets. It's crucial to understand the mechanics behind it to avoid making costly investment mistakes. This temporary rally typically occurs because of various factors, often intertwined and difficult to predict with certainty.

One contributing factor is simply profit-taking by short-sellers. After driving the price down, they may choose to cover their positions by buying back the stock, which creates upward pressure. Another cause can be bottom-fishing, where investors, believing the stock has reached its lowest point, start buying in hopes of a rebound. Sometimes, it's just irrational exuberance, fueled by positive news or rumors, even if the fundamentals of the company haven't actually improved.

However, the crucial point is that these rallies are usually short-lived because they lack fundamental support. The underlying weaknesses in the company or the broader market conditions that led to the initial decline haven't disappeared. So, while it might be tempting to jump on the bandwagon and try to profit from the bounce, it's essential to be cautious and do your due diligence. Are the company's financials improving? Is the industry outlook more positive? If the answer to these questions is no, it's probably just a dead cat bouncing.

It's also important to remember that a dead cat bounce can occur in any market, not just the stock market. It can happen with bonds, commodities, even real estate. The underlying principle remains the same: a temporary recovery after a significant decline, driven by short-term factors rather than a genuine improvement in the underlying asset.

Spotting a Potential Dead Cat Bounce

3. Don't Be Fooled! Recognizing the Warning Signs

So, how can you avoid being tricked by a dead cat bounce? It's not an exact science, but there are definitely some red flags to watch out for. First, look at the volume of trading during the rally. Is it significantly lower than the volume during the initial decline? If so, that's a sign that the bounce is weak and lacks conviction. A real recovery is usually accompanied by strong buying volume.

Second, pay attention to the overall market trend. Is the broader market also declining? If so, the bounce is even more likely to be a temporary phenomenon. It's much harder for a stock to buck a negative market trend. You should also examine the fundamental reasons for the initial decline. Are those reasons still valid? For example, has the company addressed the issues that caused its stock to fall? Is it cutting costs, launching new products, or taking other steps to improve its performance? If not, the bounce is unlikely to last.

Another important factor is the length of the rally. A dead cat bounce is typically short-lived, lasting only a few days or weeks. If the rally extends for several months, it's more likely to be a genuine recovery. However, it's still essential to be cautious and monitor the company's performance closely.

Finally, don't let emotions cloud your judgment. It's easy to get caught up in the excitement of a rally, especially if you're already invested in the stock. But remember, a healthy dose of skepticism is always a good thing. Don't be afraid to take profits and move on if you're not confident in the company's long-term prospects.

Dead Cat Bounce vs. Genuine Recovery

4. Distinguishing Between a Fleeting Rally and a True Turnaround

The million-dollar question, right? How can you tell the difference between a dead cat bounce and a genuine recovery? Well, there's no guaranteed method, but focusing on fundamentals is your best bet. A genuine recovery is typically driven by underlying improvements in the company's performance, the industry, or the overall economy. Look for consistent revenue growth, improving profit margins, and positive cash flow. These are all signs of a healthy business that is likely to sustain its upward trajectory.

Furthermore, a true recovery often involves new catalysts, such as innovative products, strategic partnerships, or significant changes in management. These catalysts signal that the company is actively addressing its challenges and adapting to the changing market environment. Look for sustained buying interest from institutional investors, such as mutual funds and pension funds. These investors typically have a longer-term investment horizon and conduct thorough research before making their decisions. Their involvement is a strong vote of confidence in the company's future prospects.

Unlike a dead cat bounce, a genuine recovery tends to be more gradual and less volatile. It's characterized by a steady climb in price, punctuated by occasional pullbacks, rather than a sharp, short-lived spike. And remember to compare the stock's performance to its peers. Is it outperforming its competitors? If so, that's a good sign that it's a leader in its industry and is likely to continue to thrive.

In contrast, a dead cat bounce lacks these fundamental drivers. It's often fueled by short-term factors, such as short covering or irrational exuberance. So, before you jump to conclusions, take a close look at the fundamentals and make sure the rally is supported by solid evidence.

Dead Cat Bounce Definition, History, Identification, Examples, Causes

Navigating the Market

5. Strategies for Savvy Investors

Okay, so you understand what a dead cat bounce is and how to spot the warning signs. But how can you actually avoid falling into the trap and losing money? One of the most important things you can do is to have a well-defined investment strategy. Don't just buy stocks based on hype or short-term trends. Instead, develop a long-term plan that aligns with your risk tolerance and financial goals. Diversification is your friend. Don't put all your eggs in one basket. Spread your investments across different asset classes, industries, and geographic regions.

Before investing in any stock, conduct thorough research and understand the company's business model, financial performance, and competitive landscape. Read analyst reports, listen to earnings calls, and stay informed about industry trends. Set stop-loss orders to limit your potential losses. A stop-loss order is an instruction to your broker to automatically sell your stock if it falls below a certain price. This can help you protect your capital and avoid getting caught in a prolonged downtrend.

Another crucial strategy is to be patient and disciplined. Don't feel pressured to buy or sell stocks just because everyone else is doing it. Stick to your investment plan and make rational decisions based on facts, not emotions. Rebalance your portfolio regularly to maintain your desired asset allocation. This involves selling some of your winning investments and buying more of your losing investments to bring your portfolio back into balance.

Consider using dollar-cost averaging, which involves investing a fixed amount of money in a stock or fund at regular intervals, regardless of the price. This can help you reduce your risk by averaging out your purchase price over time. And most importantly, never invest money that you can't afford to lose. Investing involves risk, and there's always a chance that you could lose some or all of your investment. Only invest money that you're comfortable losing, and always consult with a qualified financial advisor before making any investment decisions.

What Is The Meaning Of Dead Cat Bounce In Investing?

FAQ

6. Your Burning Questions Answered

Still scratching your head about dead cat bounces? Let's tackle some frequently asked questions!

Q: Is every rally after a drop a dead cat bounce?A: Nope! That's the tricky part. A genuine recovery is sustained by improving fundamentals and strong buying interest. A dead cat bounce is a short-lived blip, often driven by short-covering or temporary optimism.

Q: Can you profit from a dead cat bounce?A: Technically, yes, but it's risky. Experienced traders might try to capitalize on the brief rally, but it requires quick thinking, tight stop-loss orders, and a willingness to bail out at the first sign of trouble. It's not for the faint of heart!

Q: What's the best way to avoid being fooled by a dead cat bounce?A: Do your homework! Look at the fundamentals, check the trading volume, and consider the overall market trend. A healthy dose of skepticism and a well-defined investment strategy will serve you well.

Q: Does the "dead cat bounce" only apply to stocks?A: Not at all! It can happen in any market where assets experience a significant drop followed by a brief, unsustainable recovery. Think bonds, commodities, even real estate. The principle is the same.